The Art Market for Art Lovers and investors

Not all works of art by famous artists need to be hugely expensive. Illustrated is a pen and ink drawing by the notable Impressionist artist, Pierre Auguste Renoir which we are currently offering for sale. It will be included in the forthcoming Catalogue Raisonne by Wildenstein, Paris. Such works can be acquired for about the cost of a family car today and are likely to prove to be good long term investments.

Buying Art can be described as an occupation of Passion. It is something we do because we have an inherent love of things beautiful, historic and cultural. It is something inside the cultivated civilised man or woman which gives joy and pleasure. All connoisseurs of art say one thing: buy what you like. This mantra is true now as it always has been. However in todays marketplace the thorny issue of money is ever present . Many will buy Art having no cultural or aesthetic interest but being attracted solely by the probability of financial gain.

Speculating in the Art Market is not something new. The ancient Romans bought, sold and commissioned masterpieces realising their financial worth. Renaissance Princes, British Monarchs, American Industrialists and Greek Oligarchs have since continued this tradition. Today the market has opened considerably so that people of different social and financial positions can become involved in it. Humble artisans and Billionaires can be connoisseurs and collectors of Fine Art. The creation of the artists multiple (Mainly Original Limited Edition prints) has created democratisation: with a comparatively small amount of money signed works by great artists can often be bought for a relatively affordable sum. We can supply an unsigned Original Picasso Lithograph, for example, for under £300-00.

To successfully invest in Art it is necessary to have an understanding of what the marketplace is and where it is going. It is also useful to have an awareness as to what is “hot”, what is “cool” and where the “smart money” is being placed. Long term and short term trends need to be carefully analysed and a proper “entry” and “exit” strategy considered. The connoisseurship strategy too needs attention: which items and why are they being bought?

An example of how not to approach this question happened recently. I viewed a collection of Modern British Art collected over many years by a wealthy lawyer. Certainly he had spent a lot of money in acquiring his treasures but, as I passed by his canvases, I was struck by a certain feeling of mediocrity. This wealthy lawyer had bought only what he considered bargains on each and every occasion. There were no “jewels in the crown". There were no “bright shining lights". Perhaps the “entry strategy” had been badly considered. The collector could have easily afforded to pay a great deal more for individual treasures and had a great deal more personal satisfaction from his pursuit. A consistent need to get a bargain got in the way of such a pleasure.

A friend of many years was a great connoisseur and collector of Byzantine bronze weights. For many years he bought the very best that came up for sale. Many thought him crazy for paying these super high auction prices but he loved what he bought and, in the end, had the finest collection in the world. When the time came for him to sell two major UK Museum buyers emerged. They wanted the chance to acquire such superlative works and there was nowhere else where they could be found. He proved his detractors wrong and made a great deal of money on the disposal of the collection.

The term “Art Market” is in danger of being simplistically considered. There are many disparate markets and these are right now in a state of considerable change. Market forces and economic considerations are creating opportunities and pitfalls which have not been seen in recent times before. It is a commonly believed fallacy that the value of art has risen, is rising and will continue to rise. Most art will constantly fall in value and be an extremely bad investment. Some art will make an excellent Short Term Investment but, in the long term, perform badly. Let the buyer beware.

An interesting case study is the collection of the celebrated Economist John Maynard Keynes who is best known for his analysis of the theories moderating the swings of business cycles laying the foundation of modern macro-economics. Keynes had a collection of 135 works, acquired in the early years of the century, which ultimately came into the collection of the Fitzwilliam Museum in Cambridge. He had paid for £13,000 for his collection and by 2013 the holding was valued at over £70 Million representing an annualised return of about 4.2% over the previously half century which virtually matched the increase in the equities market over the same period. Interestingly some 80% of the purchase price was spent on just 10 key works which, in 2013, were estimated to be worth some 91% of the complete portfolios value. In todays market place many of the Keynes purchases were certainly long term bad buys. An analysis perhaps might show that some of those “bad buys” , until recent falls in now less favoured artists, had been “good buys”. Careful consideration of the exit strategy is vital.

There are great rewards in investing in art and considerable pitfalls too. Having dealt in Art for over 30 years I would say that without the “passion” it becomes a much less meaningful exercise. Myself I constantly get a thrill and excitement in seeing a beautiful and rare work and the people who do this entirely for the money have, somehow, missed much of the point. Art raises the spirit and excites the soul. Even without a financial gain it is worth pursuing in its own right.

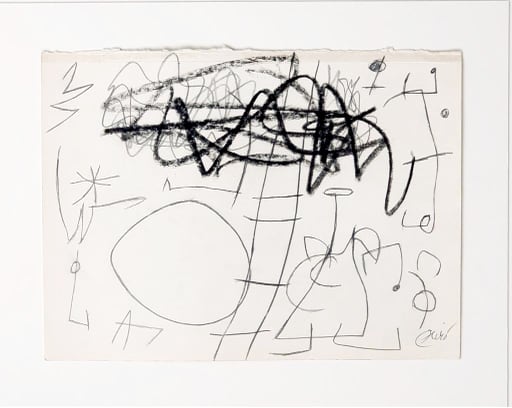

The cover piece for this blog is a Joan Miro pencil and crayon drawing and can be seen here:

https://www.fairheadfineart.com/store/product/joan-miro-paysage-anime

Niall Fairhead

Director

Fairhead Fine Art Ltd